ROI, or return on investment, is a key financial metric that helps businesses answer two critical questions: how effectively advertising investments are paying off and whether they are generating a return on marketing campaigns. This metric serves as one of the primary tools for marketers to manage their advertising budget.

In this article, we will cover everything you need to know about ROI: its definition, importance, calculation methods, success criteria, and how it differs from other indicators such as ROMI and ROAS. In addition, at the end of the article, you’ll find a bonus: useful tips on how to improve this ratio to increase profitability and return on sales.

ROI of investments: what it means

ROI is a key financial metric that helps determine the effectiveness of your investment. In simple terms, ROI shows how much return you get on every dollar you invest. To calculate ROI, it is important to consider two main factors:

- Costs: This is the amount of money invested in your project or business. For example, if you are an internet marketer, your investment includes the total cost of all the advertising campaigns you run online. Choose a specific period, such as a month, and calculate how much money you spent on promoting your product;

- Revenue: This is the amount of money you earned during the period you ran your advertising campaigns.

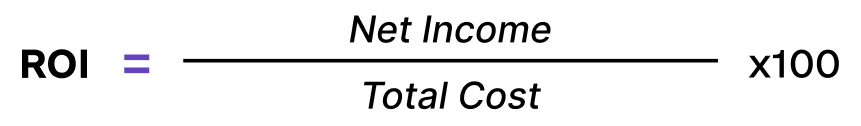

How to calculate ROI:

Knowing these two values (costs and revenues), you can easily calculate ROI using the formula: ((costs – revenue) / investment) x 100%. Let’s say you have an online store of handmade costume jewelry. In January, you spent $170 on social media advertising. You ended up selling $425 more merchandise than you normally would without advertising. Then the ROI of your marketing campaign would be ((425 dollars – 170 dollars) / 170 dollars) x 100% = 150%.

ROI, ROMI, ROAS – in simple words in marketing and advertising

In the world of marketing and advertising, terms like ROI, ROMI, and ROAS play a key role, and it’s important to understand what they mean and how they differ from each other.

ROI (Return on Investment) is a measure of the return on all investments in a business. This includes all expenses, from renting premises to purchasing stationery. In the context of an online business, ROI covers the costs of web domain, promotions, employee salaries, and so on. It shows how efficiently a business is utilizing its total investment.

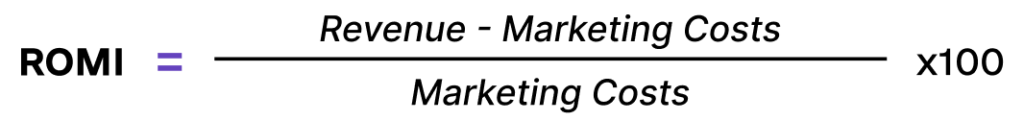

ROMI (Return on Marketing Investment) is a specialized metric that reflects the return on marketing investment. It takes into account only those costs that are directly related to product promotion, including contextual advertising, media advertising, SEO, email newsletters, and so on. ROMI helps to determine how effective various marketing channels are, which is important for optimizing the marketing strategy.

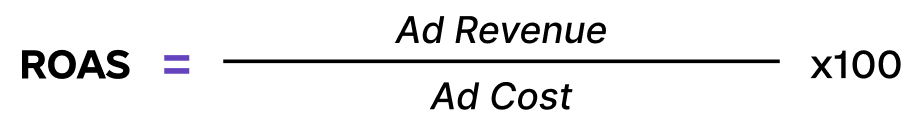

ROAS (Return on Advertising Spend) is a metric that measures the profitability of specific advertising campaigns. Unlike ROMI, which measures all marketing efforts as a whole, including marketing department salaries, ROAS focuses solely on the costs and revenues associated with specific promotions.

Why you need to calculate ROI

Calculating ROI is key to business and personal finance:

ROI is a universal metric used to evaluate the performance of different types of investments, whether it’s stocks, real estate, or office equipment. For example, before introducing new products into a product line, professionals calculate ROI by considering the cost of goods, logistics, and employee salaries.

Understanding ROI allows companies to determine how well their products or services are performing. If ROI is low, it may indicate a need to optimize departments or change strategy. In advertising, for example, ROI helps evaluate the success of campaigns and decide whether it’s worth investing in further promotion.

ROI can also be applied to personal finance. For example, if you are planning to buy new appliances to rent out an apartment, you can calculate ROI by considering the cost of the equipment and the potential rent increase.

It is important to realize that in some cases, especially when financial gain is not the primary objective (e.g. when organizing charity events or establishing animal shelters), ROI should be used in conjunction with other methods of evaluating investment performance.

Understanding Return on Investment (ROI) calculation with a simple example

Let’s look at how to calculate return on investment (ROI) with an easy-to-understand example using one of the simplest formulas. Imagine that you bought 100 shares of some company for $8 per share, investing a total of $800. Later, the stock price went up to $10 and you decided to sell all of the shares, netting you $1,000. To calculate the ROI, we subtract the initial investment ($800) from the sale amount ($1,000), divide the result by the initial investment and multiply by 100%. The result is an ROI of 25%.

It’s important to remember that an ROI below 100% doesn’t always mean a loss. It all depends on the specific industry. For example, an ROI of 25% may be considered low in the construction of high-rise residential buildings, but it is considered a good result when selling stocks.

ROMI calculation

In anticipation of February 14, the restaurant launched an advertising campaign on Google Ads. Total advertising costs amounted to $195, and the services of a freelance marketer cost $130. The restaurant’s revenue for the week of advertising activity reached $1,300.

To determine the ROMI, we subtract the total marketing expenses ($325) from the revenue ($1,300) and divide the resulting amount by the marketing expenses. Thus, ROMI is: (($1,300 – $325) / $325) × 100% = 300%.

It should be noted that calculating the total return on marketing investment may not always reflect an accurate picture. Not all of a company’s revenue may be a direct result of marketing efforts. For example, table reservations at a restaurant for February 14 could have occurred without Google Ads.

ROAS calculation formula

Let’s look at how ROAS works using the example of an online pet supply store. This store invested in social media advertising to attract new customers. The advertising campaign lasted for two months, costing the business $480. During this time, the store’s net profit reached $1280. Based on this, the ROAS for the two months was: ($1280/$480)x100% = 267%. This means that every dollar invested in advertising generated $2.67 in revenue.

In another example, imagine you’re in the business of selling handmade pottery and you run targeted ads on Instagram. For the month, you spend $80 on promotion, but your revenue is only $64. In this case, the ROAS is ($64/$80)x100% = 80%. This shows that the advertising costs exceeded the income you received from it.

Three ways to calculate ROI

ROI calculation can be done manually, which is convenient when you have a small amount of data, for example, when you are only counting revenues and expenses. However, when you have a lot of data, it is easy to get lost in the numbers or miss key points. To avoid this and save time, you should use other methods:

Checkroi is a calculator that will also calculate various other marketing metrics: CTR, CPM, CPC, CPA, and CPS.

Ciox is a standard ROI calculator for advertising.

Using an Excel spreadsheet. This tool allows you to work with any amount of data, transparently showing how your ROI adds up. Unlike using a calculator or manual calculations, Excel provides a complete picture of income and expenses. Each column in the table has a different name, such as “Revenue”, “Cost of Advertising”, “Logistics Costs” and so on, allowing you to see, for example, that your email marketing costs are about $27 at the current exchange rate. This approach makes ROI calculations transparent and easy to verify.

What ROI is considered a good ROI

A good ROI for any advertising channel should exceed 100%. This means that you are earning more than you spend on advertising.

If the ROI is less than 100%, it’s a bad sign. It means that you are spending more on advertising than it generates revenue and your business is making losses. In such a case, you should abandon such an advertising channel or completely change your advertising strategy, including texts, photos, and videos.

The situation when ROI is 100% is not ideal either. In this case, you earn exactly as much as you spend on advertising, which means that your time and efforts are not profitable.

Let’s look at an example. Let’s say you sell children’s toys on Instagram. You run targeted ads and spend $333 on them over two months. Your revenue is 917 dollars. In this case, the ROI will be:

ROI = (($917$ – $333) / $333) x 100% = 175%

Since your ROI is greater than 100%, this means you are making a profit.

For Instagram sales, an ROI of around 150% is considered good. If your ROI is over 200%, it might be worth increasing your marketing budget as it generates significant revenue.

Nuances in the ROI calculation

ROI depends on more than just marketing. Other important elements include product quality and quantity, cost of goods, service levels, and so on. For example, if a marketing campaign attracts 1,000 customers but delivery problems are hindering sales, this will lower your ROI.

ROI doesn’t always indicate a specific source of revenue. If you use multiple marketing channels, such as social media, banners, and email newsletters, it can be difficult to determine which channel attracts more customers. ROI gives an overall view of the effectiveness of all marketing efforts.

Marketing campaigns and their results can vary over time. For example, a marketing campaign may be in February, but an order may not arrive until May. It is important to keep in mind that the response to an advertisement can occur even after the advertisement is over. Example: you announce new smartphones in your store, such as “Samsung Galaxy S22 priced at $999.” The customer may see the ad, but purchase after some time. Thus, the effect of advertising on ROI may not show up immediately.

Difficulties in calculating the financial indicator ROI

Let’s say you invested $1,000 in shares of company XX and sold them for $5,000 after 5 years. And then you invested the same amount of money in shares of company XY and sold them for 5000 dollars after 2 years. In both cases, your return was 400%, but XY stock was more profitable because it yielded a return three years earlier than XX stock.

For example, an investor may use one methodology to calculate ROI and a company may use another. This can lead to discrepancies in the data, especially important in negotiations, as different parties will have different return figures.

ROI is not static; it changes over time. This means that to adequately assess the return on your investment, you need to regularly review and analyze this figure to ensure that your investment is still profitable.

How to increase ROI

Return on investment, or ROI, is a key metric that shows how effectively your investments are generating revenue. To improve this metric, it’s important to focus on reducing expenses, especially in marketing. By avoiding common mistakes when launching advertising campaigns, you increase your chances of improving your ROI.

Ways to ensure a high ROI value:

- Make sure your landing page matches the promises in the ad. For example, if the ad promises MacBooks in Kyiv, the visitor should land on a page with MacBooks, not refrigerators.

- Evaluate the ROI of each advertising channel separately, using web analytics tools such as Yandex Metrica or Google Analytics. This will help you determine which sources are most effective.

- Divide your advertising budget between different channels and track their profitability. This will allow you to identify and eliminate unprofitable sources.

- Don’t invest all your funds in one campaign. Create different ads with different text and images, assign a test budget, and track the effectiveness of each ad.

- Investments don’t always yield immediate results. For example, investing in improving an online store’s website may not immediately increase ROI, but it’s important for long-term growth and customer satisfaction.

Conclusion

ROI is a major indicator of the success of your investment. To make sure that your business is bringing in more than it is spending, you should closely monitor and improve the return on your investment.