Don't miss interesting news

Our country is constantly leading in various rankings of the use of digital currencies. For example, in 2022, Chainalysis ranked Ukraine third in the global cryptocurrency usage index.

Ukrainians have been using cryptocurrency transactions for a long time, but there is a problem with paying taxes. Tax specialists provide different information, which can lead to tax evasion by individuals.

In this article, we will consider the possibility of legalizing income from cryptocurrency transactions in Ukraine. We will analyze legislative norms and provide advice for individual entrepreneurs.

In February 2023, the President of Ukraine approved the Law on Virtual Assets, which partially recognizes the status of digital currencies. In April, the tax service provided clarifications on taxation. According to the new rules, citizens will have to pay 18% tax and 1.5% military duty.

On paper, everything looks perfect, but in real life, the system needs to be improved. Profits from the sale of cryptocurrencies are considered foreign income, which explains the high tax rate. This causes dissatisfaction among active cryptocurrency users.

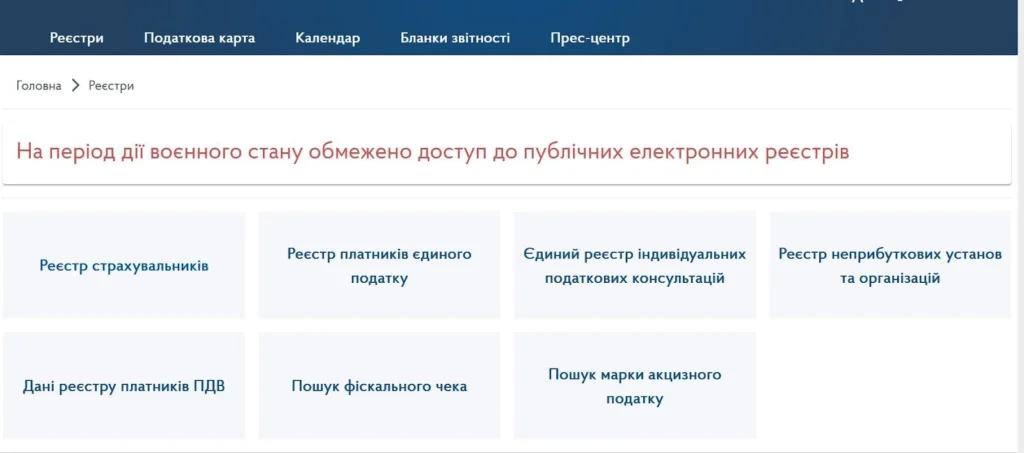

In the near future, the tax service plans to create a register of taxpayers working with cryptocurrencies, where individuals will be able to enter data on their transactions and pay taxes. However, the high tax rate may scare off many users who will not want to legalize their income.

Progress is being made in legalizing cryptocurrencies, but there is a significant problem for individual entrepreneurs. Currently, the law prohibits single tax payers from accepting payments in forms other than cash, including cryptocurrencies. Therefore, without additional tools, it will not be possible to work with cryptocurrencies legally.

In general, the topic of cryptocurrency integration into the country’s financial system is a painful one. Government agencies are moving in this direction slowly, and the conditions are still far from ideal. For example, back in 2021, Monobank promised to support cryptocurrencies, but this issue has not yet been resolved.

Ukrainian individual entrepreneurs often deal with cryptocurrency, but due to imperfect legislation, they are not able to accept it as payment for their services. This makes many arbitrators postpone registration as an official entrepreneur, in particular because of this problem.

Affiliate programs have long been using cryptocurrency as their main payment instrument. However, if a partner is registered as a sole proprietor, he will not be able to accept such funds to his account and include them in the single tax payer’s declaration.

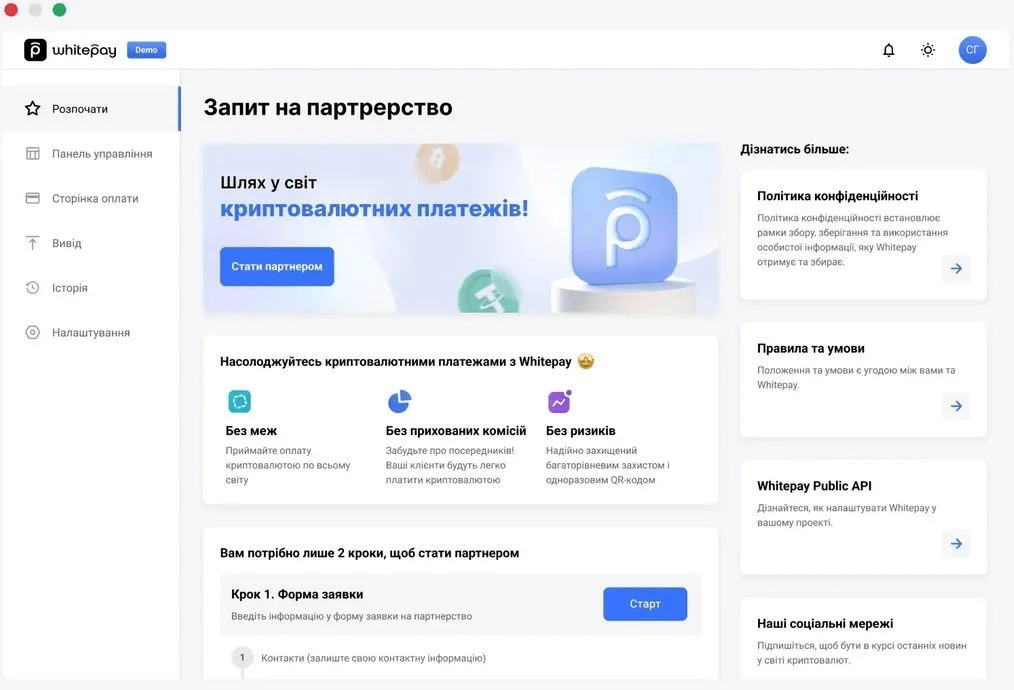

However, a tool has recently appeared on the financial technology market that allows legalizing cryptocurrency transfers for individual entrepreneurs. Acquiring from the Ukrainian exchange Whitepay makes it possible to accept payments in cryptocurrency with subsequent conversion to hryvnia.

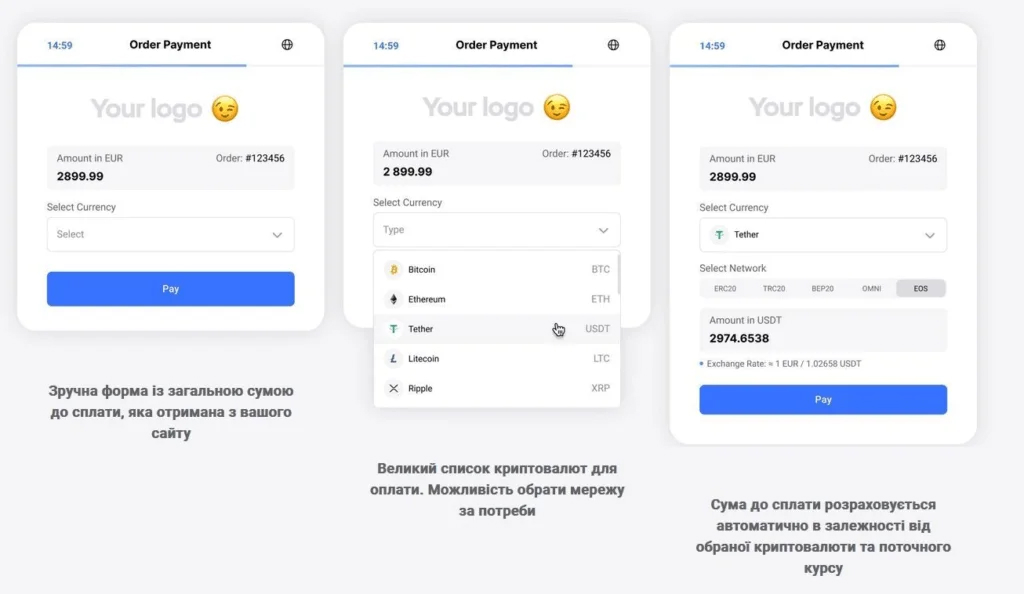

The process for an entrepreneur is as follows: creating an invoice for a client, receiving payment in one of the supported cryptocurrencies, crediting funds to the account, and ordering a payment in hryvnia. The entrepreneur receives the money to his account in a Ukrainian bank.

Whitepay has a licensed financial company that can seamlessly make transfers in hryvnia and provide reporting documents through the Vchasno electronic document management system.

If you are an arbitrator or freelancer with an open sole proprietorship, you can accept cryptocurrency payments from clients by following 4 steps:

While Whitepay acquiring is still in its infancy, the connection conditions are simple. Unlike Liqpay, Fondy, and other payment platforms, you do not need to have a website or an app to receive payments. You can provide a link to the freelance marketplace profile or indicate that payments come from affiliate programs.

At the moment, the only fully legal way to work with cryptocurrency is to act as an individual, file an annual property declaration, and pay a tax of 18% + 1.5%. Sole proprietors report separately, as before.

Although the option with Whitepay seems ideal, theoretically, the tax service may pay attention to the fact that the sole proprietorship accepts payments in cryptocurrency. However, this is unlikely, since the payment is actually received in UAH from the legal entity Whitepay.

It should be remembered that the sole proprietor must keep the primary documents for each payment. The agreement with Whitepay for the transfer of funds is important, but the actual money comes from the clients. So, you will need contracts or invoices for foreign clients.

Making payments in cryptocurrency without using Whitepay or similar services may lead to the cancellation of the simplified taxation system. In this case, the tax for the quarter in which the violation occurred will be 19.5% instead of 5%.

Possibly, in the future, Ukrainian banks will allow opening cryptocurrency accounts, which will reduce the need for third-party payment instruments. However, this is unlikely to happen in the next 3-5 years or more. Therefore, the use of cryptocurrency acquiring currently saves time and allows you to legalize arbitrage or freelance activities.

Demand for cryptocurrencies in the payment instruments market will grow. The choice to use it or not is up to each individual. Although it is quite difficult to work in the affiliate sphere without digital assets.