Don't miss interesting news

Everyone dreams of money, but not everyone likes to work. Some people need it to survive, others need it to launch new projects, and still others need it for hobbies or interests. When money is tight, people usually look for a job or a place to borrow money. Today we will not talk about HR, but about ways to make money on human financial needs and banking products.

The main element in the financial sector is banking offers, mostly loans. This is the main product offered by all banks, regardless of their size. Loans can be issued for various purposes, but the most popular are consumer loans for ordinary citizens. In addition to consumer loans, there are also loans for refinancing, business, mortgages, etc.

Loans differ from loans in that they are provided by microfinance organizations (MFOs) rather than banks. They offer loans with higher interest rates, fewer requirements to qualify, and greater risks for both the webmaster and the borrower (it is not always known who is behind a particular MFI).

Another interesting product is investments. These can be investments from individuals or foundations, or contributions from citizens. Investments can be represented by stocks, bonds, shares, and interest. This also includes brokerage services.

The issuance of debit cards is one of the types of offers that are transparent and understandable to everyone. The key action is the customer’s order of a card from a particular bank with the fulfillment of certain KPIs: accumulation of the amount, number of transactions, activation, etc.

Business services include banking, insurance (useful for ordinary citizens as well), cash management and legal services.

Some areas, such as investments, franchises, and cash management, are less common. First, the targeted traffic for them is much smaller compared to loans, borrowings, or cards. Secondly, other methods are often used here, and you need to be inventive to succeed. Let’s talk about the approaches below.

Payments in the financial sector are carefully monitored and based on the performance of targeted actions by users. For example, in the field of lending, the amount of payments is determined by the amount of the loan that the user has taken out. In fact, these payments are made at the expense of the interest that the bank or MFI receives from the loan.

When selling services, the payment is made by the company whose services you are promoting. In investments, the remuneration is usually a share of the investment capital allocated for partnership fees and other indirect costs.

The basic principle in the financial sector is that advertisers and affiliate programs rarely pay upfront: each offer involves the performance of a targeted action. There are offers where you can get bigger payouts if you complete more targeted actions or deposit more money. However, most often, especially for new affiliates, these payments are fixed and depend only on the fact of CPA (CPL) fulfillment.

The financial industry is one of those where customers are actively engaged through both online and offline campaigns. What’s more, you can even get involved. Simple methods, such as posting leaflets with QR codes or links to landing pages, call centers for loan selection (some advertisers pay for the call), are quite workable solutions. It is important to consider the possibilities and legality of such actions in certain countries.

Let’s turn to the Internet. Approaches to financial services in all their aspects have long been consistently converting:

Personalized displays, keyword matching, cards with offer options, simple and clear terms and conditions – all this can be obtained from traffic platforms such as search engines and social networks. The ability to experiment with approaches and a large number of potential customers at your disposal.

Newsletters are a cost-effective way to find those who need services. As a rule, newsletters are used in mass products (cards, loans) or in dubious projects, so it is recommended to work only through official affiliate programs with official advertisers.

Finally, your own resources. These can be channels, groups, video reviewers, websites with articles, etc. The most common approach is showcases. Similarly to gambling reviewers, showcases for loans offer convenient filters for choosing the best option. Ready-made showcases are already provided by affiliate programs themselves – you just need to direct traffic to them.

But! No one limits your imagination. You can come up with and implement anything you want. For example:

So, it all depends on your creativity. By the way, most companies develop their own creatives for different advertising formats, whether it’s Facebook feed ads, YouTube banners, or ads next to search results.

Like any financial industry, this area is not without its challenges. Let’s discuss the main problems.

You may not get paid. Webmasters often face this problem when receiving their earnings, and clients – when paying interest or services. To avoid this, you should work only with trusted partners. Finance is a transparent field, and you shouldn’t take any risks here.

Watch out for the terms and conditions of offers. Products carefully control the quality of traffic and set strict requirements for sources, creatives, and promotion methods. Besides, not all platforms allow running such ads.

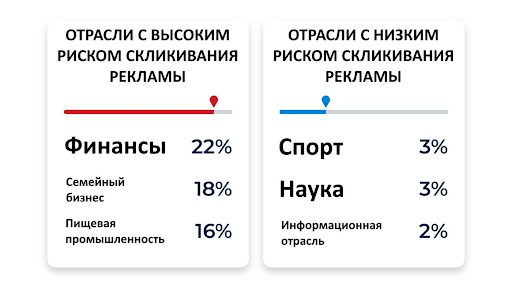

Your ads may be subject to click attacks: competitors may click on your ads en masse when they see them. If you pay the ad platform for each click, it can quickly deplete your budget. Platforms are fighting against this phenomenon, but that doesn’t mean you should ignore it.

Despite all these difficulties, finance is an industry that almost no one talks about openly because of the significant financial flows that circulate in it. Instead of high-profile conferences, players gather in narrow circles at private events, discuss strategies and share experiences, continuing to increase their revenues.